Mississippi River

Des Moines County, Iowa

Rooted in CommunityWhat's Happening

Apr

25

Hike A Park - Wilson Lake

4:00 pm · 2195 220th St. · Donnellson, IA

May

9

Hike A Park - Linder Conservation Area

6:00 pm · 13807 170th St. · Sperry, IA

May

16

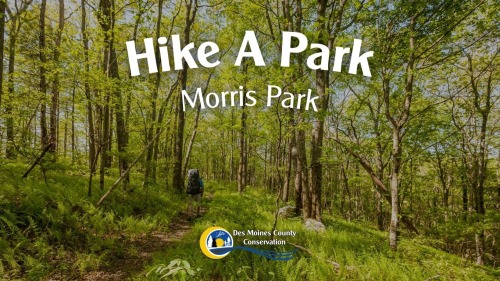

Hike A Park - Morris Park

4:00 pm · 10938 Timber Rd. · Stockport, IA

May

30

Hike A Park - Lindsay Wilderness

4:00 pm · 22994 CR-W40 · Bonaparte, IA

News and Announcements

Job Opening: Big Hollow Watershed Coordinator

Posted 4/19/24

Job Opening: Part-Time Kitchen Cook

Posted 4/10/24

Notice of Public Hearing on FY25 Budget

Posted 4/9/24

Golf Course Rd - Road Closure

Posted 4/4/24

Property Taxes Due April 1, 2024

Posted 3/25/24

NOTICE OF PROPOSED PROPERTY TAX LEVY & HF718 LETTER

Posted 3/18/24

Job Opening: Volunteer Camp Host

Posted 2/20/24

Job Opening: Assistant County Attorney

Posted 12/5/23

Conservation department adds 19.4 acres to Hickory Bend

Posted 11/27/23

Welcome to Des Moines County, Iowa

Des Moines County was established in 1833. It's home to 5 communities and over 38,000 residents. The County is administered by a three-member Board of Supervisors who are elected for four-year terms. Other elected officials include the Attorney, Auditor, Recorder, Sheriff, and Treasurer.

Stay Connected

Sign up to receive notifications when board meeting agendas are posted, job openings are announced, and more!